Bruno Morety – Exit preparation partner (EU).

Corporate Finance turned

Exit Preparation Partner.

Why owners work with me for premium exit multiples:

Corporate Finance Rigor

5+ years in corporate finance.

I translate operator numbers into buyer-grade

clarity.

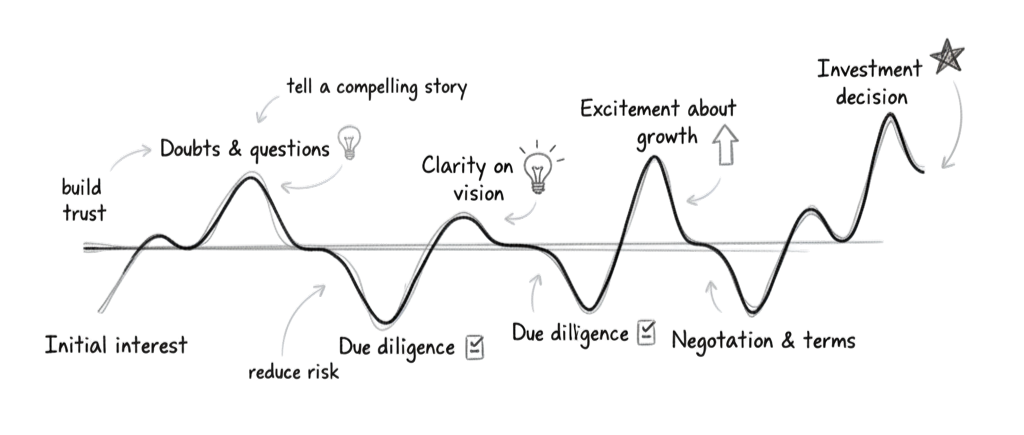

Narrative & Risk Framing

Value drivers, risk answers,

and a clean “why pay a premium” case.

Deal Materials + Negotiation Prep

Tight materials for review and diligence,

plus prep to defend your price in the room.

You run the business.

I’ll make the case for the premium multiple.